Tags: Anti-Bribery & Corruption (ABC)

This report by Hogan Lovells examines the approaches, concerns and regional differences of multinational corporates across the globe on all aspects of anti-bribery & corruption, with a particular focus on expansion into high-risk markets.

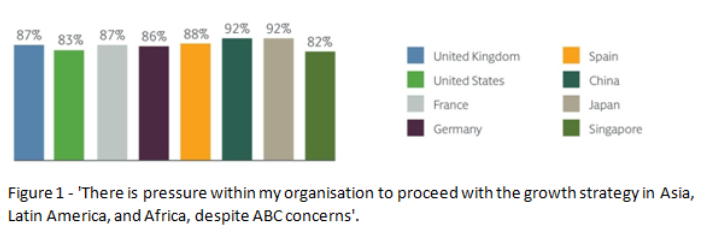

Hogan Lovells produced this report as un update to their 2016 report Steering The Course. The research was conducted with a sample of 700 'compliance leaders', defined as compliance officers (CCOs), heads of legal or equivalent, working in multinational companies with at least 2,000 employees, who had been in post for at least one year. Respondents from eight different markets (UK, US, France, Germany, Spain, China, Singapore and Japan) were involved.

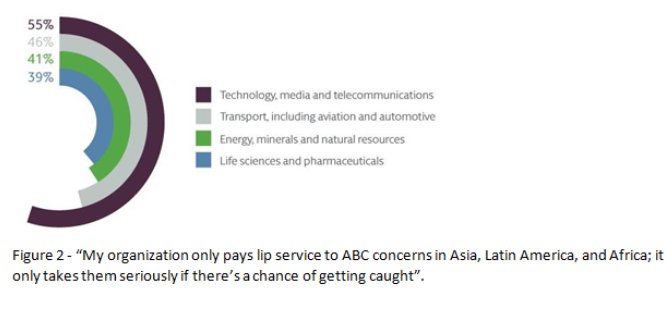

The study focused on four high-risk sectors at the heart of global ABC regulation and investigations: technology, media and telecommunications (TMT); life sciences and pharmaceuticals; energy, minerals and natural resources; and transportation, including aviation and automotive.

Pressure Points

- More than two-thirds (68%) of compliance leaders believe that regulatory pressure is increasing.

- Over half (52%) say that although ABC demands are ever-growing, their organization is cutting overall budgets.

- Only 41% of compliance leaders said that their ABC budget had increased over the last three years, compared to 88% in 2016.

- Just 42% of compliance teams have grown over the last three years, compared to 89% in 2016's research.

The Two Sides of Tech

- Technology is a double-edged sword for compliance leaders. As technology provides new ways to work, it brings both challenges and opportunities for AB&C compliance.

- 56% of respondents feel that emerging alternative currencies like Bitcoin present a challenge from a compliance perspective.

- Attitudes towards technology and compliance exhibit regional variation; in China, more than two-thirds (68%) of compliance leaders have concerns about communications taking place over messaging apps, while the overall figure is 57%.

- 56% have concerns about the decreasing importance of human analysis in compliance relative to technology.

The Sector Viewpoint

- Of the four sectors the research focuses on, technology, media and telecommunications (TMT) professionals were most likely to feel that ABC is not a priority for their organisation (51%) and are also most likely to be dealing with budget cuts.

- At the same time, however, TMT sector organisations are the most likely to have large (20 people or more) ABC teams at 40% compared to an all-sector average of 32%. Almost half (49%) of TMT respondents said the head of ABC reports directly to the CEO, compared to just 38% across all sectors.

- Life sciences and pharmaceutical organisations are most likely to get external evaluations of their ABC programmes done, but the figure is still low (18%). Across all sectors, the figure was 16%. Companies in the sector are also more likely to regularly update their ABC framework (25% vs 19% average).

- The transport sector lags behind the other focus sectors; organisations were least likely to have increased their ABC budget over the last three years, least likely to test the effectiveness of their ABC programmes, and least likely to seek external evaluation. Leaders in the sector were also least likely to expect their team to grow in the near future.

- The energy, minerals and natural resources sector fared little better, outperforming only the transport sector in each of the categories mentioned in the previous bullet point.

Regional Observations

- There is a strong correlation between the markets that have not been entered due to high bribery and corruption risk, and those where respondents have seen the biggest increase in local enforcement in the last 10 years.

- Latin American nations are the most likely to be avoided entirely due to high bribery and corruption risk. Brazil, Argentina, Bolivia, and Belize are the markets that companies are most likely to have chosen not to enter due to AB&C concerns.

- The three African markets that raise the most bribery and corruption concerns are the three biggest economies on the continent, measured by GDP: Nigeria, South Africa and Egypt.

- The Asian market identified as the biggest source of concern is China, although Chinese compliance leaders are the most likely to say that regulatory pressure is increasing (80%, compared to an average of 68%).

- Over half (57%) of businesses made guidelines available in local languages in 2016, but only 30% currently take this approach.

- Fewer than a third of organizations have localized supplements to their global AB&C policy for Asia (29%) and Latin America (28%), and fewer than a quarter have localized their policies for Africa (24%).

Conclusions

With budgets tightening and regulation evolving, the pressure to develop high-quality, efficient ABC programmes is greater than ever. Many organisations struggle to balance this pressure with the commercial need for expansion into new markets, including those identified as high-risk for bribery and corruption. Commercial growth and comprehensive compliance programs are not mutually exclusive, and organisations can make the most of new markets while avoiding risk if they invest in their ABC programmes and seek to achievable sustainable growth through a proactive, transparent approach to governance.

The strong correlation between markets commonly rejected for their ABC risk and those where enforcement has sharply increased indicates that governments 'have had to sit up and take notice of large organizations’ expansion plans and clean up their local law enforcement to encourage entry to their market'.

The proliferation of technology presents both challenges and opportunities for ABC compliance. Opinion seems to be quite divided amongst practitioners on whether the threats outweigh the benefits or vice versa.